In a surprising move, Dai-ichi Life Holdings, a prominent Japanese insurance company, has announced its intention to launch a competing takeover bid for Benefit One, a corporate welfare benefits provider in Japan. This unexpected maneuver marks a departure from Dai-ichi Life Holdings’ long-standing position as a stable shareholder in the Japanese market. The announcement comes hot on the heels of a previous takeover bid by M3, an operator of medical information websites, for the same company. This development could potentially signal a turning point for mergers and acquisitions (M&A) in Japan.

The Unconventional Counterproposal

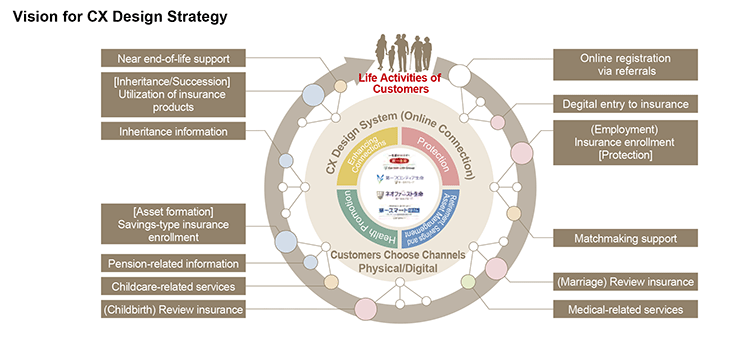

Dai-ichi Life Holdings’ decision to challenge the existing bid for Benefit One is a bold move that underscores its determination to expand its business beyond the realm of insurance. While the company has traditionally focused on the insurance sector, this counterproposal demonstrates its eagerness to diversify its offerings and venture into non-insurance areas.

To execute its competing bid, Dai-ichi Life Holdings will need to navigate the complex landscape of M&A negotiations and secure the necessary approvals from regulatory bodies. This will undoubtedly be a challenging endeavor, as it entails convincing shareholders and stakeholders of the potential value and synergies that can be achieved through the acquisition of Benefit One.

The Significance of Dai-ichi Life Holdings’ Strategy

Dai-ichi Life Holdings’ decision to pursue a takeover bid for Benefit One represents a strategic shift for the company. By entering the corporate welfare benefits market, Dai-ichi Life Holdings aims to tap into a sector with significant growth potential. This diversification strategy aligns with the company’s broader goal of expanding its business portfolio and reducing its reliance on the insurance industry.

Furthermore, this move by Dai-ichi Life Holdings could have broader implications for the M&A landscape in Japan. Historically, Japanese companies have been more conservative when it comes to M&A, preferring to maintain stability and long-term relationships with their business partners. However, this counterproposal suggests a departure from this traditional approach, potentially signaling a new era of more aggressive deal-making in the country.

The Potential Benefits of the Acquisition

If successful, the acquisition of Benefit One could provide Dai-ichi Life Holdings with several strategic advantages. Firstly, it would allow the company to leverage Benefit One’s expertise in corporate welfare benefits, enabling it to offer a more comprehensive suite of services to its customers. This expanded offering could lead to increased customer loyalty and satisfaction, ultimately driving growth and profitability.

Additionally, acquiring Benefit One would provide Dai-ichi Life Holdings with access to a new customer base and distribution channels. By integrating Benefit One’s network into its existing operations, Dai-ichi Life Holdings could expand its reach and penetrate new markets, further diversifying its revenue streams.

Overcoming Challenges and Gaining Approval

While Dai-ichi Life Holdings’ counterproposal presents exciting opportunities, it also presents significant challenges. Successfully executing the takeover bid will require navigating complex negotiations and securing the necessary approvals from regulatory bodies and shareholders. Additionally, effectively integrating Benefit One into Dai-ichi Life Holdings’ operations will require careful planning and execution to ensure a smooth transition.

To gain approval for the acquisition, Dai-ichi Life Holdings will need to present a compelling case to shareholders and regulatory bodies. This case should highlight the strategic rationale behind the acquisition, the potential synergies that can be achieved, and the long-term value it will bring to the company and its stakeholders. Building consensus and addressing any concerns raised by stakeholders will be critical to the success of the bid.

Implications for the M&A Landscape in Japan

Dai-ichi Life Holdings’ counterproposal to acquire Benefit One could mark a significant shift in the M&A landscape in Japan. Traditionally, Japanese companies have been cautious when it comes to pursuing mergers and acquisitions, prioritizing stability and long-term relationships over aggressive deal-making. However, this bold move by Dai-ichi Life Holdings suggests a departure from this conservative approach and a willingness to embrace more assertive strategies.

If successful, this counterproposal could inspire other Japanese companies to pursue similar avenues for growth and diversification. It may also signal a broader shift in the perception of M&A as a viable strategy for driving business expansion and creating value. This potential change in mindset could open up new opportunities for both domestic and international companies looking to enter the Japanese market or establish strategic partnerships.

Conclusion

Dai-ichi Life Holdings’ decision to launch a competing takeover bid for Benefit One represents a bold move that challenges the status quo of M&A in Japan. By diversifying its business portfolio and venturing into non-insurance areas, Dai-ichi Life Holdings aims to tap into new growth opportunities and reduce its dependence on the insurance industry. If successful, this acquisition could provide the company with strategic advantages, such as expanded service offerings and access to new customer segments. Moreover, this counterproposal could signal a broader shift in the M&A landscape in Japan, encouraging other companies to adopt more aggressive strategies for growth and value creation. As this story continues to unfold, it will be interesting to see how the dynamics of M&A in Japan evolve and what implications this may have for businesses both within and outside the country.