Introduction

The U.S. tax code underwent significant changes during the Trump administration, including modifications that affected individuals’ charitable giving to colleges and universities. This article delves into the implications of these tax reforms on the number of donors and the size of individual donations. Drawing on peer-reviewed research published in the Journal of Higher Education Policy and Management, we explore the consequences of the Tax Cuts and Jobs Act of 2017. We also examine the potential effects on STEM education funding, student tuition, and access to higher education. The Impact of Tax Changes on College Donations: A Comprehensive Analysis.

The Tax Cuts and Jobs Act of 2017: A Catalyst for Change

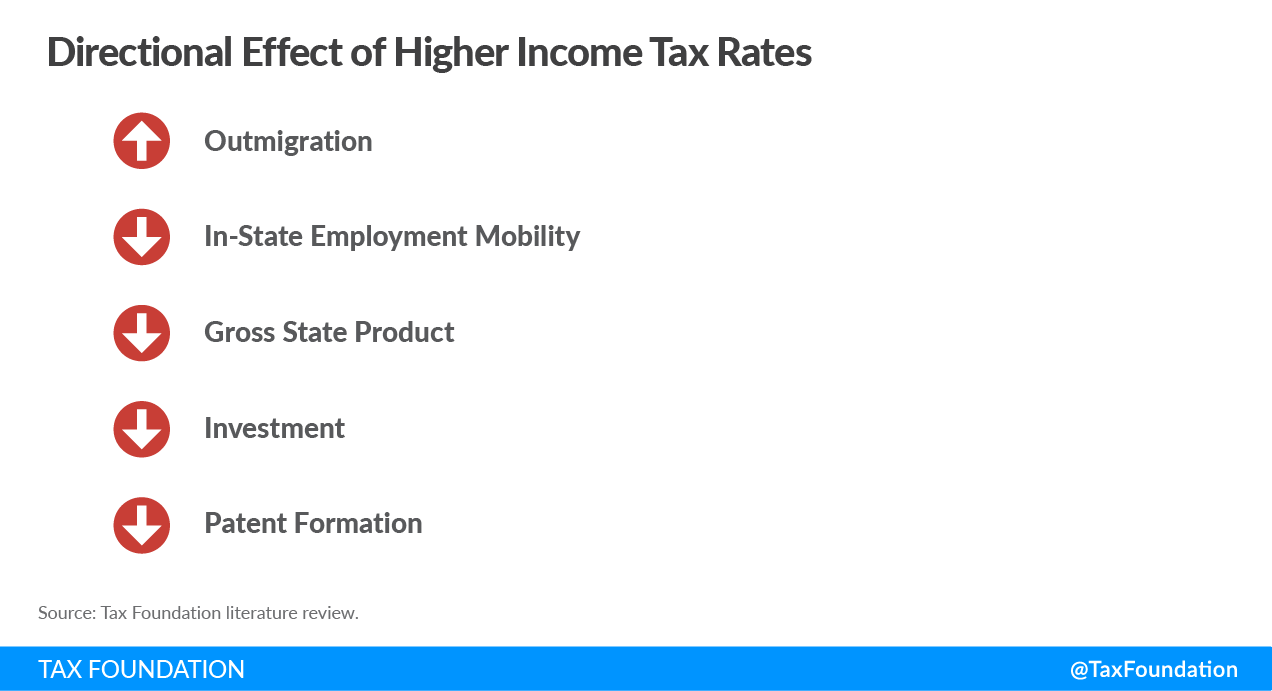

The Tax Cuts and Jobs Act of 2017 brought about substantial alterations to the U.S. tax code. One of the key changes was the nearly doubled standard deduction, which reduced the tax benefits middle-income taxpayers previously enjoyed from charitable giving. Consequently, the research published in the Journal of Higher Education Policy and Management reveals a decline in the number of individuals donating to colleges and universities.

The Impact on Colleges and Universities

Decrease in Individual Donors

According to the research, the overall effect on the number of individual donors and revenue from small donations may not be significant in the short term. However, over time, the cumulative impact becomes evident. Private research universities, in particular, experienced the most significant decline in the number of donors. This decline raises concerns about the future funding and investment in STEM education.

Pressure to Raise Tuition

As individual donations decrease, colleges and universities face increased pressure to find alternative funding sources. One potential solution is to raise tuition fees, which can have far-reaching consequences for students. Increased tuition rates may limit access to higher education, particularly for low-income students. The research suggests that this change in individual donations could potentially influence students’ ability to pursue college in the future.

Philanthropic Donations and High-Income Taxpayers

While the Tax Cuts and Jobs Act of 2017 had a notable impact on individual donations, it did not lead to an overall decrease in total charitable giving. High-income taxpayers continued to enjoy tax benefits from donations and, in fact, donated at higher levels. However, it is essential to recognize that big philanthropic donations primarily benefit a small section of colleges and universities, focusing on endowment funds or specific facilities.

The Role of Individual Donations in STEM Education

Individual donations have long played a crucial role in supporting STEM programs and facilities in colleges and universities. The federal government has shown a particular interest in upgrading STEM education, making individual donations even more critical. However, with the decline in individual donors due to the tax code changes, institutions may struggle to maintain and enhance their STEM programs and facilities.

Adapting to Changing Funding Resources

To mitigate the impact of reduced individual donations, colleges and universities must explore alternative funding resources. One potential approach is to increase tuition fees. However, this strategy may have unintended consequences, such as limiting access to higher education for low-income students. Another option institutions might consider is expanding legacy admissions, which could further exacerbate inequities in college access.

The Need for Continued Support

While large philanthropic donations continue to contribute to the financial well-being of colleges and universities, individual donations remain vital for the sustainability of STEM programs and facilities. The research emphasizes the importance of maintaining a diverse funding portfolio to ensure the long-term viability of higher education institutions.

Conclusion

The Tax Cuts and Jobs Act of 2017 brought about significant changes to the U.S. tax code, resulting in a decline in the number of individuals donating to colleges and universities. Private research universities were particularly affected, raising concerns about the future funding of STEM education. As colleges and universities navigate these challenges, they must seek alternative funding resources while considering the potential impact on student tuition and access to higher education. It is crucial to ensure that the drive for financial sustainability does not hinder the pursuit of educational equity and excellence. By adopting innovative strategies and fostering a diverse funding portfolio, institutions can work towards a future where quality education remains accessible to all.