Introduction

In the ever-evolving landscape of business financing, revenue based finance has emerged as a popular alternative to traditional funding options. This comprehensive guide will provide you with a deep understanding of revenue based finance, its benefits, drawbacks, and how it can be leveraged to fuel the growth of your business. Whether you are a startup looking for capital or an established company seeking expansion funds, this guide will equip you with the knowledge to make informed decisions.

What is Revenue Based Finance?

Revenue based finance, also known as revenue-based financing or revenue-based lending, is a funding model that allows businesses to secure capital in exchange for a percentage of their future revenue. Unlike traditional loans that require fixed monthly payments, revenue based finance offers flexibility by aligning repayment terms with the company’s revenue stream. This means that during periods of low revenue, the repayment amount decreases, alleviating some of the financial burden on the business.

How Does Revenue Based Finance Work?

Revenue based finance is structured around a repayment agreement that typically includes a repayment period and a revenue share percentage. The repayment period can vary, but it is commonly set between 12 to 36 months. During this period, the business makes regular payments as a percentage of its revenue. The revenue share percentage, which is agreed upon between the business and the investor, determines how much of the revenue will be used for repayment.

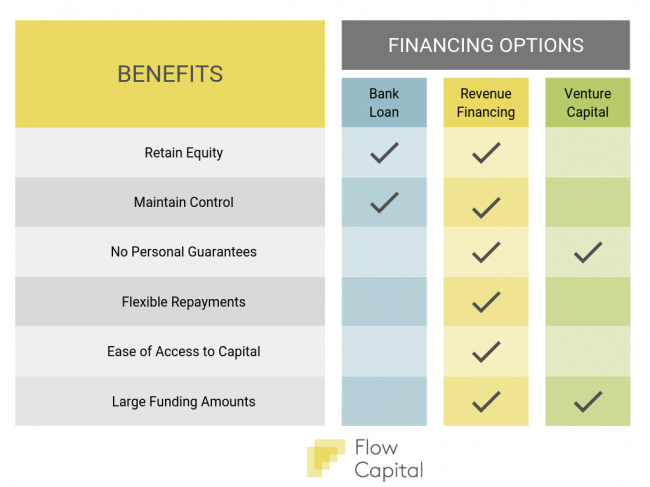

Advantages of Revenue Based Finance

1. Flexible Repayment Structure

One of the key advantages of revenue based finance is its flexible repayment structure. Unlike traditional loans with fixed monthly payments, revenue based finance adjusts repayment amounts based on the company’s revenue. This provides businesses with the flexibility to manage their cash flow and navigate through periods of low revenue without straining their finances.

2. No Collateral Requirement

Traditional loans often require collateral as security for the borrowed amount. Revenue based finance, on the other hand, does not typically require collateral. This makes it an attractive option for businesses that may not have valuable assets to use as collateral or are hesitant to put their assets at risk.

3. Quick Access to Capital

Securing traditional loans can be a lengthy process involving extensive paperwork and approval procedures. Revenue based finance offers a faster alternative, allowing businesses to access capital quickly. This can be especially beneficial for startups and small businesses that need immediate funds to seize growth opportunities.

4. Shared Risk with Investors

In revenue based finance, investors share the risk with the business. Since repayment is tied to the company’s revenue, investors only receive payments if the business generates revenue. This alignment of interests encourages investors to actively support the growth and success of the business.

Disadvantages of Revenue Based Finance

1. Higher Cost of Capital

Compared to traditional loans, revenue based finance often comes with a higher cost of capital. The revenue share percentage, which determines the repayment amount, can be higher than the interest rate of a conventional loan. This is because revenue based finance carries additional risk for the investor, as they are dependent on the business’s future revenue.

2. Potential Long-Term Impact on Profits

While revenue based finance provides businesses with flexibility in repayment, the long-term impact on profits should be considered. Since a percentage of revenue is allocated towards repayment, it may impact the overall profitability of the business. This can be a trade-off for businesses seeking immediate capital but may hinder long-term growth potential.

3. Limited Funding Amounts

Revenue based finance may not be suitable for businesses requiring large amounts of capital. Due to the nature of the funding model, the maximum funding amount is often limited compared to traditional loans. This can pose challenges for businesses with significant growth plans or those operating in capital-intensive industries.

How to Qualify for Revenue Based Finance

To qualify for revenue based finance, businesses typically need to meet certain criteria set by investors or lending institutions. While specific requirements may vary, here are some common factors that investors consider:

- Revenue History: Investors usually require a minimum revenue history to assess the business’s financial stability and revenue-generating potential.

- Growth Potential: Investors look for businesses with strong growth potential to ensure a favorable return on their investment.

- Industry and Market Analysis: The industry and market in which the business operates play a crucial role in determining its eligibility for revenue based finance. Investors assess market trends, competition, and growth prospects.

- Business Plan: A well-developed business plan that outlines the company’s strategy, market positioning, and growth projections is essential to demonstrate viability and attract investors.

How to Apply for Revenue Based Finance

Applying for revenue based finance involves several steps to ensure a smooth and successful process. Here is a step-by-step guide to help you navigate the application process:

- Research and Identify Potential Investors: Conduct thorough research to identify investors or lending institutions that offer revenue based finance. Look for those with experience in your industry and a track record of successful investments.

- Prepare Your Business Documentation: Gather all the necessary documentation, including financial statements, revenue history, business plan, and any other relevant information that showcases the potential of your business.

- Craft a Compelling Pitch: Develop a persuasive pitch that highlights your business’s unique value proposition, growth potential, and how revenue based finance can accelerate your growth trajectory.

- Submit Your Application: Submit your application to the selected investors or lending institutions. Follow their guidelines and ensure that all required documents are included.

- Negotiate Terms: If your application is successful, you will receive offers from investors. Review the terms carefully, negotiate where necessary, and seek legal advice if required to ensure a fair agreement.

- Close the Deal: Once you have selected the most suitable investor and agreed on the terms, finalize the deal by signing the necessary legal documents.

Examples of Revenue Based Finance Models

There are various revenue based finance models that businesses can explore based on their specific needs and circumstances. Here are a few examples:

- Royalty Financing: In this model, investors receive a percentage of the business’s revenue until a predetermined return on investment is achieved. After reaching the target return, the revenue share percentage decreases or ceases altogether.

- Revenue Share Agreement: This model involves a fixed percentage of the business’s revenue being allocated for repayment. The repayment continues until the agreed-upon amount is fully paid.

- Merchant Cash Advance: Commonly used in industries such as retail and hospitality, this model provides businesses with upfront cash in exchange for a percentage of their future credit card sales.

Conclusion

Revenue based finance offers businesses a flexible and accessible funding option that aligns with their revenue stream. While it comes with its own set of advantages and disadvantages, it can be a valuable tool for startups and small businesses seeking capital to fuel growth. By understanding the intricacies of revenue based finance and following the application process, businesses can make informed decisions and secure the funding necessary to achieve their goals.

Remember, revenue based finance is not a one-size-fits-all solution, and it is crucial to evaluate your business’s specific needs and financial situation before committing to any funding arrangement. By doing so, you can leverage revenue based finance effectively and propel your business towards success.

Additional Information: The tone of voice for this article should be informative, authoritative, and professional. The primary keyword is “revenue based finance,” and secondary keywords include “alternative funding,” “flexible repayment,” “shared risk,” “higher cost of capital,” and “qualify for revenue based finance.”